The crypto industry has seen many challenges, but a recent report from Solidus Labs highlights a growing issue that demands attention. According to the findings, 98.6% of tokens launched on Pump.fun are either rug pulls or part of pump-and-dump schemes , raising serious concerns about investor safety and platform transparency.

Pump.fun, a token-launching platform built on the Solana blockchain , allows users to create new tokens at minimal cost. Since its launch in January 2024, over 7 million tokens have been created on the platform. However, only around 97,000 tokens still hold liquidity of $1,000 or more, suggesting most projects vanish shortly after launch.

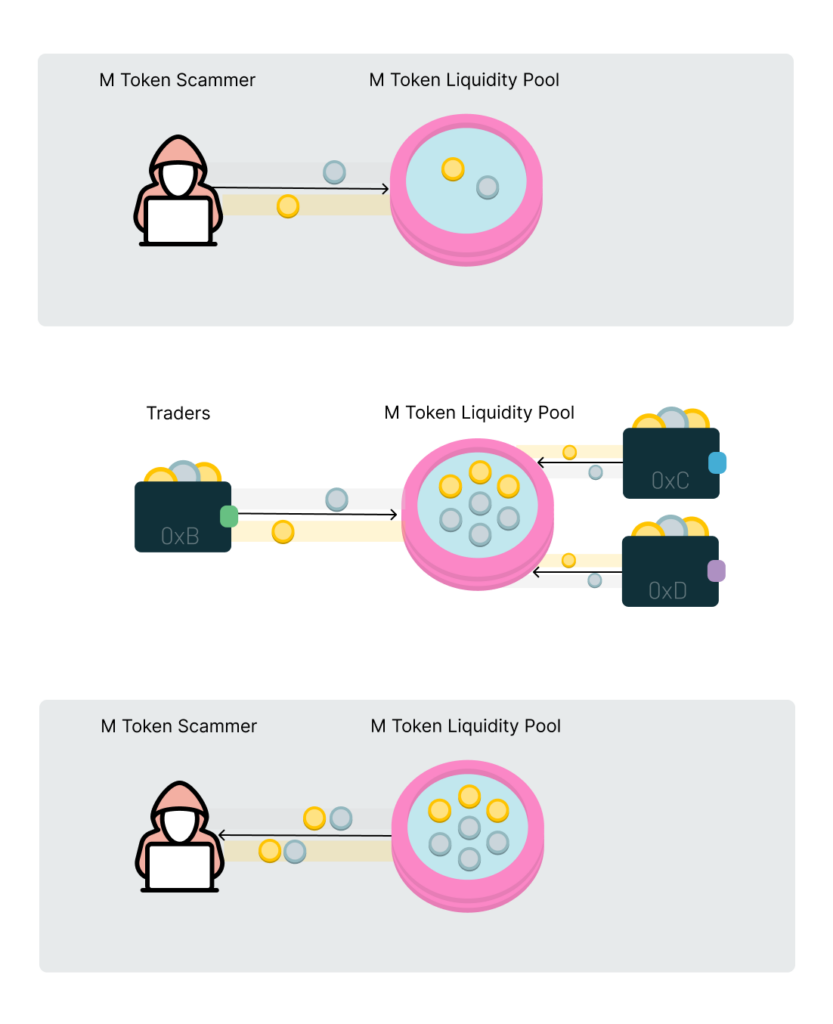

One of the largest rug pulls identified involved a token called MToken , which drained nearly $1.9 million from unsuspecting investors. These types of scams often follow a predictable pattern: creators attract buyers with hype, then suddenly remove liquidity, leaving holders with worthless assets.

Memecoins: A Hotbed for Scams

Memecoins continue to be a major draw for retail investors, especially those chasing quick profits. This trend peaked in January when former U.S. President Donald Trump promoted his TRUMP memecoin on social media. Shortly after, First Lady Melania Trump launched her own token, MELANIA .

While both tokens initially saw massive interest, they’ve since lost 87% and 97% of their value, respectively. Meanwhile, insiders reportedly made over $100 million by buying in early before public listing.

This kind of activity isn’t limited to political figures. Every day, tens of thousands of fake or speculative tokens appear across platforms. Many of these projects lack real utility or development, making them ripe for exploitation.

Rug Pulls Are Widespread Across DEXs

Beyond Pump.fun, Solidus Labs found similar patterns on Raydium , a popular decentralized exchange (DEX) on Solana. Around 93% of liquidity pools – equivalent to 361,000 pools – show signs of “soft” rug pulls, where developers gradually drain funds instead of pulling liquidity all at once. The average loss per pool stands at $2,800.

These numbers reflect a broader problem within the DeFi space, where bad actors exploit the anonymity and speed of blockchains like Solana. With near-zero transaction fees and fast processing times, launching and dumping tokens becomes easier than ever.

Regulatory Eyes Are Watching

Despite the rising fraud, regulators are stepping up efforts to protect investors. In March 2025, the U.S. Securities and Exchange Commission (SEC) formed a new unit focused on Web3 and Emerging Technologies. Its mission? To track down individuals misusing innovation to harm investors and undermine trust in digital assets.

Then in April, the SEC filed a lawsuit against Meteora , accusing key members behind the memecoin M3M3 of orchestrating a $69 million rug pull. This case marks one of the largest enforcement actions taken so far against fraudulent token projects.

Final Thoughts: Proceed with Caution

While decentralized finance offers exciting opportunities, it also comes with risks. Platforms like Pump.fun provide easy access to token creation, but without proper safeguards, they become playgrounds for scammers.

Investors must stay informed, do their research, and avoid jumping into hyped-up projects without understanding the team, technology, and long-term goals behind them.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before investing. We are not responsible for any investment decisions you make.