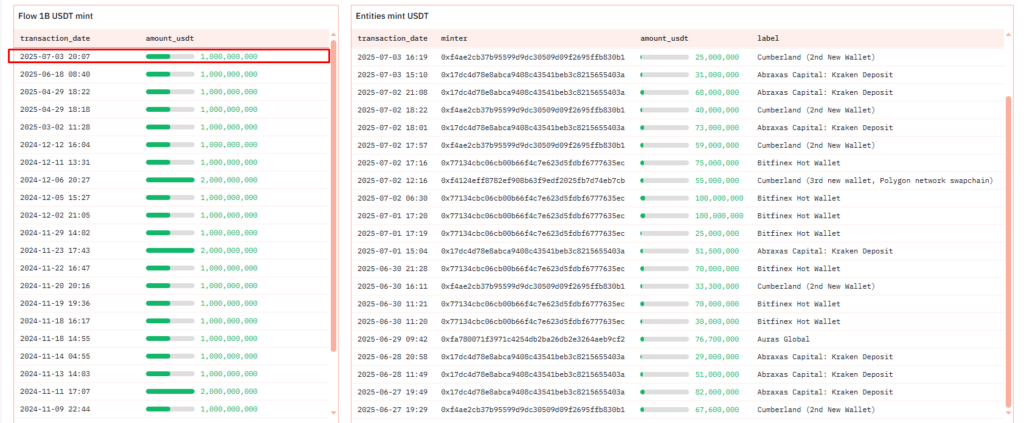

Early this morning, Tether minted $1 billion worth of USDT on the Ethereum network. This coincided with U.S. Independence Day. It marks the second billion-dollar mint in less than two months. This follows a similar issuance on June 18. According to 52Hz, the minting signals a continuation of increased demand for the stablecoin. It is intended to rebalance Tether’s reserves.

The newly minted tokens are approved but not yet issued. This means they do not immediately contribute to Tether’s overall market capitalization. However, the move underscores the growing appetite for USDT as a cornerstone of the cryptocurrency ecosystem.

Rising Demand for USDT on the Ethereum Network

The recent minting highlights a positive trend for the broader crypto market. As noted by analysts, such large-scale mints often signal strong institutional or retail demand for stablecoins.

Since the beginning of 2023, Tether has issued over $16 billion in new USDT. This brings its total market value to more than $83.2 billion, a record high. The consistent issuance reflects Tether’s dominance in the stablecoin space. It also reflects its critical role in facilitating liquidity across exchanges.

Minting on the Ethereum network, in particular, is seen as a bullish indicator. Ethereum remains one of the most widely used blockchains for decentralized finance (DeFi) and trading activities. This makes it a preferred platform for stablecoin transactions.

Tether’s Role in Bitcoin’s Market Dominance

The timing of the mint aligns with a notable increase in Bitcoin’s dominance. It surged to over 50% of the total cryptocurrency market valuation early Saturday morning. This rise in Bitcoin dominance typically coincides with declines in the altcoin market. Traders shift their focus to safer assets during periods of volatility.

While Bitcoin’s liquidity makes it an attractive option for risk-averse investors, Tether’s USDT provides an alternative method of mitigating exposure to market instability. As the most widely adopted dollar-pegged stablecoin, USDT allows users to hedge against volatility without completely exiting the crypto ecosystem into fiat currency.

Factors Driving USDT’s Growing Popularity

Several factors have contributed to the increasing reliance on USDT in the current market environment:

- Altcoin Market Decline: The recent downturn in altcoins has driven investors toward stablecoins like USDT as a safe haven.

- Concerns Over Competitors: Price fluctuations in other stablecoins, such as TrueUSD (TUSD) , have raised concerns among users. This further solidifies Tether’s position as the go-to stablecoin.

- Ease of Use: Tether offers a straightforward way for traders to navigate market turbulence without converting entirely to traditional fiat currencies.

These dynamics have reinforced Tether’s dominance, even as regulatory scrutiny around stablecoins continues to intensify.

Implications for the Broader Crypto Market

The issuance of $1 billion USDT comes amid significant shifts in the cryptocurrency landscape. With Bitcoin and Tether collectively dominating the market, both assets play pivotal roles in shaping investor behavior.

Bitcoin’s resurgence in dominance reflects renewed confidence in its role as digital gold. Meanwhile, Tether’s steady issuance demonstrates its utility as a bridge between fiat and crypto markets. Together, these trends suggest that stability and liquidity remain top priorities for participants in the crypto ecosystem.

However, challenges persist. Regulatory pressures and questions about transparency could impact Tether’s operations in the future. For now, though, the company’s ability to meet demand through large-scale mints like this one reinforces its position as a linchpin of the industry.

Conclusion

This event highlights the growing demand for stablecoins and their integral role in the cryptocurrency market. As Bitcoin continues to dominate the market share, Tether provides a crucial tool for managing risk and maintaining liquidity.

For traders and institutions alike, the consistent issuance of USDT serves as a vote of confidence in the stability of the crypto ecosystem. While challenges such as regulatory oversight and competition from other stablecoins loom, Tether’s resilience ensures it will remain a key player in the evolving landscape of digital finance.

As the market navigates ongoing volatility, the symbiotic relationship between Bitcoin and Tether underscores the importance of balancing innovation with stability.