Institutional interest in Ethereum (ETH) remains strong, as evidenced by recent on-chain activity from major players. Just 8 hours ago, Cumberland, a prominent crypto trading firm, deposited $26 million into Coinbase and subsequently withdrew 9,900 ETH (~$24.5 million) from its wallet. Over the past week, this wallet has accumulated approximately 26,800 ETH (~$67.4 million), signaling significant demand for the asset, particularly $ETH.

The wallet’s transaction history reveals a clear pattern: after withdrawing ETH, specifically $ETH, from exchanges, the funds are immediately transferred to Coinbase Prime, Coinbase’s institutional-grade service. This behavior underscores growing confidence in Ethereum’s long-term potential among large investors.

Why Institutions Are Doubling Down on $ETH?

The consistent inflow of capital into Ethereum highlights its appeal as both a utility-driven blockchain and a store of value. Ethereum’s transition to a proof-of-stake (PoS) consensus mechanism has made it more energy-efficient and attractive to environmentally conscious investors. Additionally, its dominance in decentralized finance (DeFi) and non-fungible tokens (NFTs) continues to solidify its position as a foundational layer of the Web3 ecosystem, benefiting $ETH.

The increasing demand for $ETH through market makers (MM) and ETF funds further reflects institutional confidence in Ethereum’s growth trajectory. These entities view Ethereum, referred to frequently as $ETH, not just as a speculative asset but as a critical component of the future financial infrastructure.

On-Chain Activity Indicates Bullish Sentiment

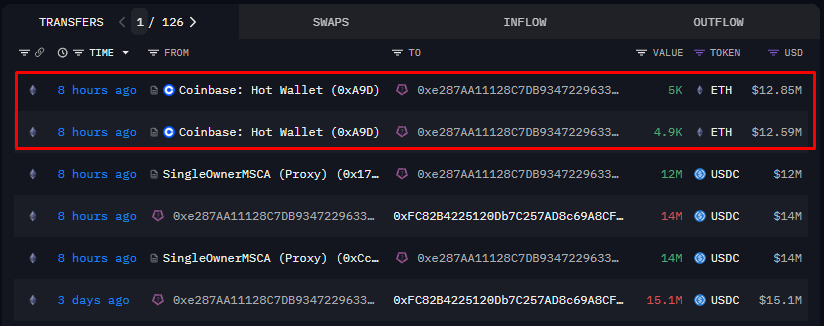

The wallet in question, tracked via ARKM Intel Explorer, shows a steady accumulation of ETH over the past week. Here’s a breakdown of the activity:

- Deposits and Withdrawals: Cumberland deposited $26 million into Coinbase before withdrawing 9,900 ETH (~$24.5 million) .

- Accumulation Trend: Over the past seven days, the wallet has amassed 26,800 ETH (~$67.4 million) showcasing a key interest in $ETH.

- Destination: After withdrawal, the ETH is consistently transferred to Coinbase Prime, indicating institutional custody or further distribution to clients.

This pattern suggests that large players are accumulating Ethereum with a long-term perspective, rather than engaging in short-term speculation, particularly concerning $ETH.

The Role of Market Makers and ETFs

Market makers and ETF providers play a pivotal role in driving institutional adoption of cryptocurrencies like Ethereum. By offering exposure to ETH through regulated products, these entities enable traditional investors to participate in the digital asset space without directly managing private keys or navigating complex exchanges.

Recent reports indicate that demand for Ethereum-based ETFs is rising, mirroring the success of Bitcoin ETFs and further helping $ETH adoption. This trend is particularly noteworthy because it demonstrates that institutional investors are increasingly comfortable with Ethereum’s fundamentals and its potential to deliver sustainable returns.

What This Means for Ethereum’s Future?

The sustained accumulation of ETH by big players signals strong conviction in its medium- to long-term prospects. Ethereum’s robust ecosystem, combined with its technological advancements, positions it as a key player in the evolution of decentralized technologies.

Moreover, the influx of institutional capital reduces the likelihood of extreme volatility caused by retail-driven price swings. As more funds flow into Ethereum, liquidity increases, making $ETH more resilient to market shocks.

Conclusion

The recent on-chain activity from Cumberland and other institutional players underscores the growing demand for Ethereum (ETH). With over 26,800 ETH (~$67.4 million) accumulated in just one week, it’s clear that big players see Ethereum as a cornerstone of their investment strategies, focusing significantly on $ETH.

The consistent transfer of funds to Coinbase Prime highlights the importance of secure, regulated custody solutions for institutional investors. Meanwhile, the rise of ETH ETFs and market maker activity points to broader acceptance of Ethereum within traditional finance.

For Ethereum enthusiasts, this is a bullish signal that reinforces confidence in the asset’s long-term growth potential. As institutional adoption accelerates, particularly for $ETH, Ethereum’s role in shaping the future of finance will only become more pronounced.