DePIN: Why D5wav Is Investing in the Future of Decentralized Infrastructure

In 2025, one of the hottest trends in crypto isn’t DeFi or memecoins—it’s DePIN, and D5wav investment in this sector is signaling a major infrastructure shift. From decentralized 5G networks to community-owned GPU nodes, DePIN is bringing blockchain into the physical world.

Most people think of crypto as digital—blockchains, tokens, on-chain finance. But what if crypto could power physical infrastructure? That’s exactly what DePIN (Decentralized Physical Infrastructure Networks) is doing.

From decentralized 5G to distributed GPU networks, DePIN is building the real-world infrastructure that powers smart cities, AI computation, and connectivity—all without Big Tech monopolies. And VCs like D5wav are betting big on this decentralized revolution.

What Is DePIN and Why Is It Exploding?

The DePIN D5wav investment thesis revolves around one idea: putting real-world infrastructure into the hands of decentralized participants using blockchain and tokenomics.

Definition and Real-World Examples

DePIN refers to physical infrastructure (like wireless networks, sensors, GPUs) that are built, owned, and maintained by decentralized participants—not corporations.

Top examples:

- Helium (IoT & 5G)

- Render Network (Decentralized GPU)

- HiveMapper (Map data mining)

- DIMO (Connected car data)

Why DePIN Matters More Than Ever in 2025

Real-World Usage + Real Ownership

DePIN is the first Web3 narrative that directly connects:

- Physical world infrastructure

- Blockchain ownership models

- Tokenized incentives

The result? Community-powered infrastructure that:

- Is cheaper to deploy

- Has no centralized gatekeepers

- Offers real ROI to contributors

Why VCs Like D5wav Are Going All-In on DePIN

A Unique Blend of Cashflow + Utility

Unlike DeFi or NFTs, DePIN projects:

- Have tangible outputs (data, compute, connectivity)

- Generate real-world revenue

- Are defensible against competitors (high hardware deployment cost)

D5wav sees DePIN as a new digital industrial revolution—and is actively investing in startups blending hardware, tokenomics, and network effects.

What DePIN Startups Are Getting Funded in 2025?

RabitiAI’s Compute Layer

RabitiAI, recently funded by D5wav, is integrating DePIN models to distribute AI model inference across physical GPU nodes—tokenizing idle computing power.

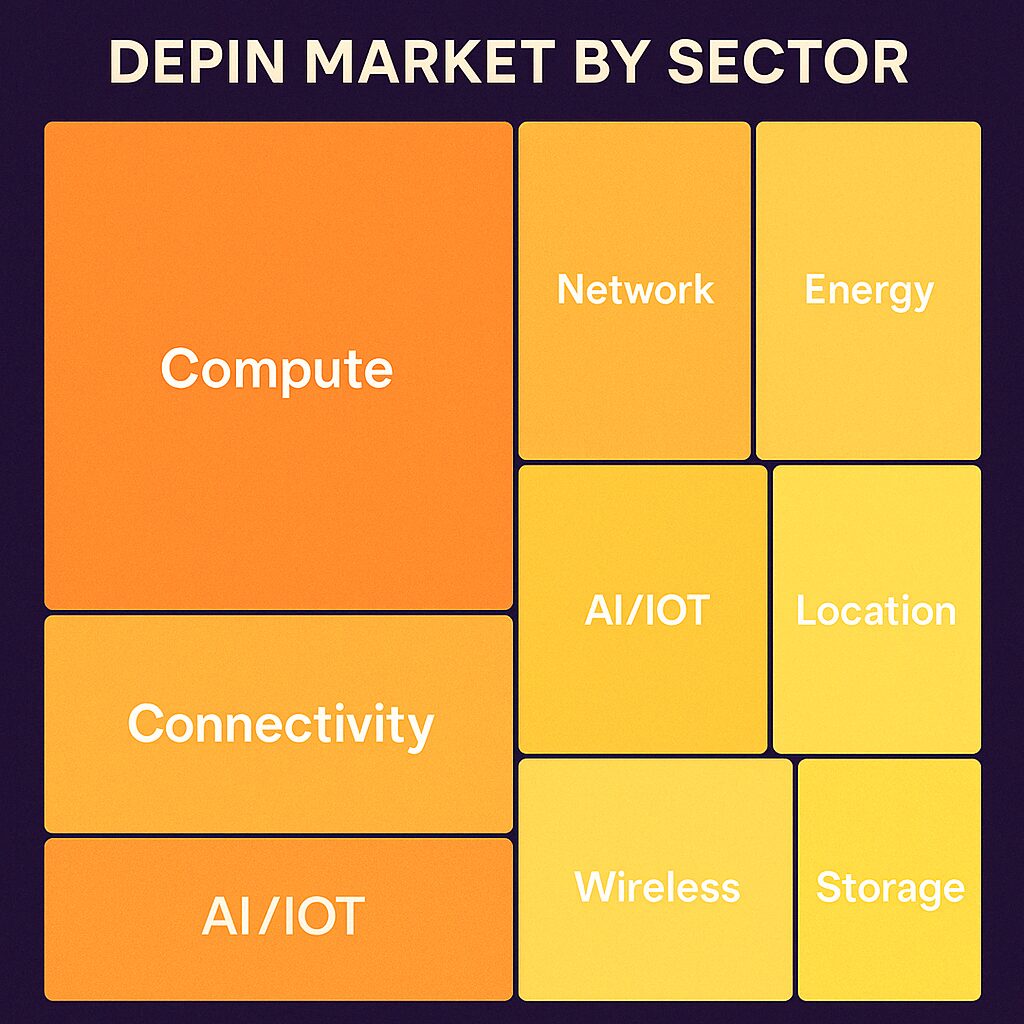

Other Sectors Heating Up

- Decentralized energy grid (e.g., PowerPod)

- Sensor networks for smart agriculture

- DePIN x RWA (real-world assets) like tokenized solar or EV charging stations

The Numbers Behind DePIN’s Rise

- Over $300M in VC investment into DePIN since Q4 2024

- Helium Mobile surpassed 1 million active hotspots

- GPU DePIN networks now rival centralized cloud compute in cost

- Average ROI for early node deployers: 3–5x

What’s Next for DePIN in 2025–2026

The Convergence of AI, Compute, and Ownership

DePIN is intersecting with:

- AI demand for decentralized compute

- IoT expansion

- Tokenized incentive models

- Sustainable energy microgrids

The next generation of DePIN won’t just power data—it will power cities, machines, and entire industries.

Conclusion: Why D5wav Sees DePIN as the Next Big Bet

DePIN isn’t hype—it’s hardware, software, and tokenomics combined into one unstoppable force. It offers what most crypto narratives don’t:

- Real-world impact

- Scalable usage

- Long-term defensibility

While the crowd chases hype, D5wav is laying the foundation—node by node, chip by chip—for a decentralized, user-owned world.

If crypto is the new internet—DePIN is the fiber optic cable, the GPU server, and the smart grid powering it.