GD Culture Group Ltd. (NASDAQ: GDC) has finalized a $300 million stock purchase agreement with an investor from the British Virgin Islands, marking a bold move to integrate cryptocurrency assets like Bitcoin and TRUMP coin into its operations. This strategic decision reflects a growing trend among companies leveraging digital currencies to diversify their financial portfolios and enhance stability amid challenges.

A Strategic Pivot Toward Cryptocurrency

The deal, announced on May 12, involves GD Culture Group and its subsidiary, AI Catalysis Corp., entering into a common stock purchase agreement with the British Virgin Islands-based investor. The company plans to use the proceeds to acquire crypto assets, including Bitcoin and OFFICIAL TRUMP tokens, as part of its treasury diversification strategy.

“The proceeds will support GD Culture Group’s crypto asset funding strategy, including the purchase of Bitcoin and OFFICIAL TRUMP tokens.” – Company Announcement, GD Culture Group Limited

This move underscores the increasing adoption of digital assets as a tool for financial innovation and resilience. However, market reactions have been mixed due to the company’s existing financial hurdles, including compliance issues with Nasdaq. Despite these challenges, industry experts acknowledge the alignment with the broader trend of integrating blockchain-driven solutions into traditional business models.

Mixed Market Reactions and Industry Trends

While the integration of cryptocurrency assets into corporate treasuries is gaining traction, GD Culture Group’s financial challenges have left some investors cautious. Compliance issues and prior setbacks have raised concerns about the company’s ability to execute this ambitious strategy effectively.

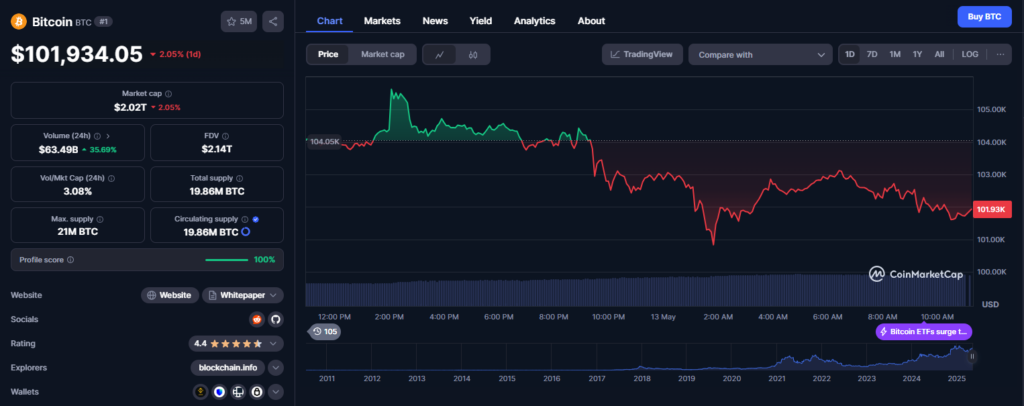

Nevertheless, the decision to adopt digital assets like Bitcoin aligns with a global trend of corporations seeking to diversify reserves and capitalize on the growth potential of blockchain technology. According to CoinMarketCap, Bitcoin (BTC) currently trades at $101,934.05, with a market cap of $2.02 trillion and dominance of 62.05%. Over the past 30 days, Bitcoin has surged by 19.87%, underscoring its role as a stabilizing force in volatile markets.

The Growing Influence of Bitcoin and Digital Assets

The inclusion of Bitcoin and other cryptocurrencies in corporate strategies mirrors steps taken by significant players in various industries. These moves highlight the growing recognition of digital assets as both a store of value and a hedge against economic uncertainty.

For GD Culture Group, this $300 million investment represents an opportunity to strengthen its position in the evolving landscape of blockchain-driven finance. Mr. Xiaojian Wang, CEO of GD Culture Group, emphasized that the initiative aims to position the company at the forefront of transformative changes in the financial ecosystem.

Final Thoughts

GD Culture Group’s $300 million crypto asset funding deal marks a pivotal moment in its efforts to navigate financial challenges through innovative solutions. While the market remains divided on the company’s prospects, the strategic embrace of digital assets signals a forward-thinking approach to modernizing operations.

As the adoption of cryptocurrencies continues to grow, companies like GD Culture Group are setting precedents for integrating blockchain technology into traditional business frameworks. Whether this strategy will yield long-term success remains to be seen, but it highlights the shifting dynamics of the global financial landscape.