The cryptocurrency market recently took a massive hit. Bitcoin dropped from its all-time high of $109,071 to nearly $75,000 (~31%), Ethereum Ethereum plummeted from $3,453 to nearly $1,400 (59%), and many altcoins evaporated like SOL slid 67% and TRUMP crashed 89%. These aren’t just price dips—they’re full-blown market crashes that test the resilience of even the most battle-hardened investors. Whether you’re a seasoned trader or a newcomer just dipping your toes into this volatile world, such dramatic swings likely left you reeling. But does this signal the end? Or is it just a challenge pushing you to grow and evolve? Let’s break down this journey through the chaos.

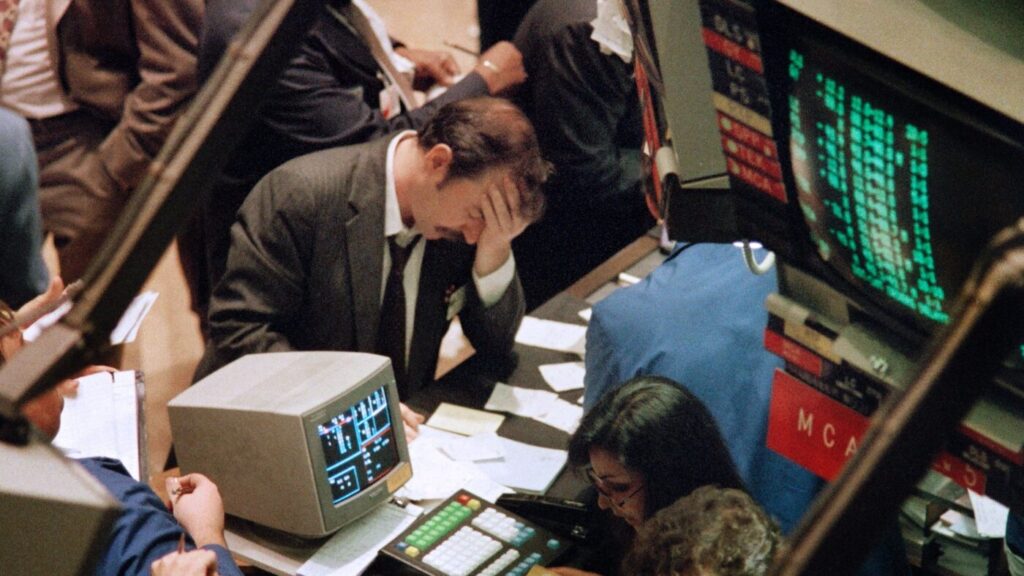

You’re Not the Only One Bleeding

As asset values nosedive, panic and helplessness creep in fast. Even veteran investors, myself included, face hefty losses during these times. The plunge isn’t just numbers on a screen—it’s a gut punch to your confidence and emotions.

From the euphoria of soaring markets to the dread of free falls, every one of us feels some kind of sting. It’s not just financial; it’s mental. No matter how well you diversified your portfolio, this phase spares no one from psychological strain.

Pause and Prioritize Self-Care First

When the market shakes violently, instinct often screams to jump in and claw back losses. That’s where most people stumble into costly mistakes.

Instead of reacting in a frenzy, hit pause. Stabilizing your mind and body matters more than any trade right now. Turn off those flashing candlestick charts, step away from the negativity flooding social media, and give yourself a break. A hearty meal, a full night’s sleep, or a calm walk can reset your headspace. Only with a clear mind can you face the market rationally—and that’s the bedrock of smart decisions.

“Power Off, Reboot” Your Body and Mind

Sometimes, the simplest fixes work wonders. Ditch the barrage of bad news and return to life’s basics to ease the tension. Try going offline for a day—unplug from phones and laptops. Take deep breaths, tune into your body. That quiet moment recharges your inner strength. Before worrying about your account balance, focus on restoring yourself.

Review Losses Calmly and Logically

Once your emotions settle, grab a pen and paper to dissect your investment journey. Don’t beat yourself up—dig into the “why” behind your losses. Did you over-leverage? Skip setting a stop-loss? Chase FOMO or unverified rumors? Jot down every lesson. The sting of loss hurts, but the insights you gain become priceless tools for the future.

Rebuild Step by Step From the Ground Up

Forget rushing into the next big opportunity. Start by piecing your life back together. Sleep well, eat right, move your body—these habits bolster your physical and mental resilience. As you slip back into a steady routine, the unease fades. Rebuilding isn’t just a prep to re-enter the market; it’s an upgrade to your entire self.

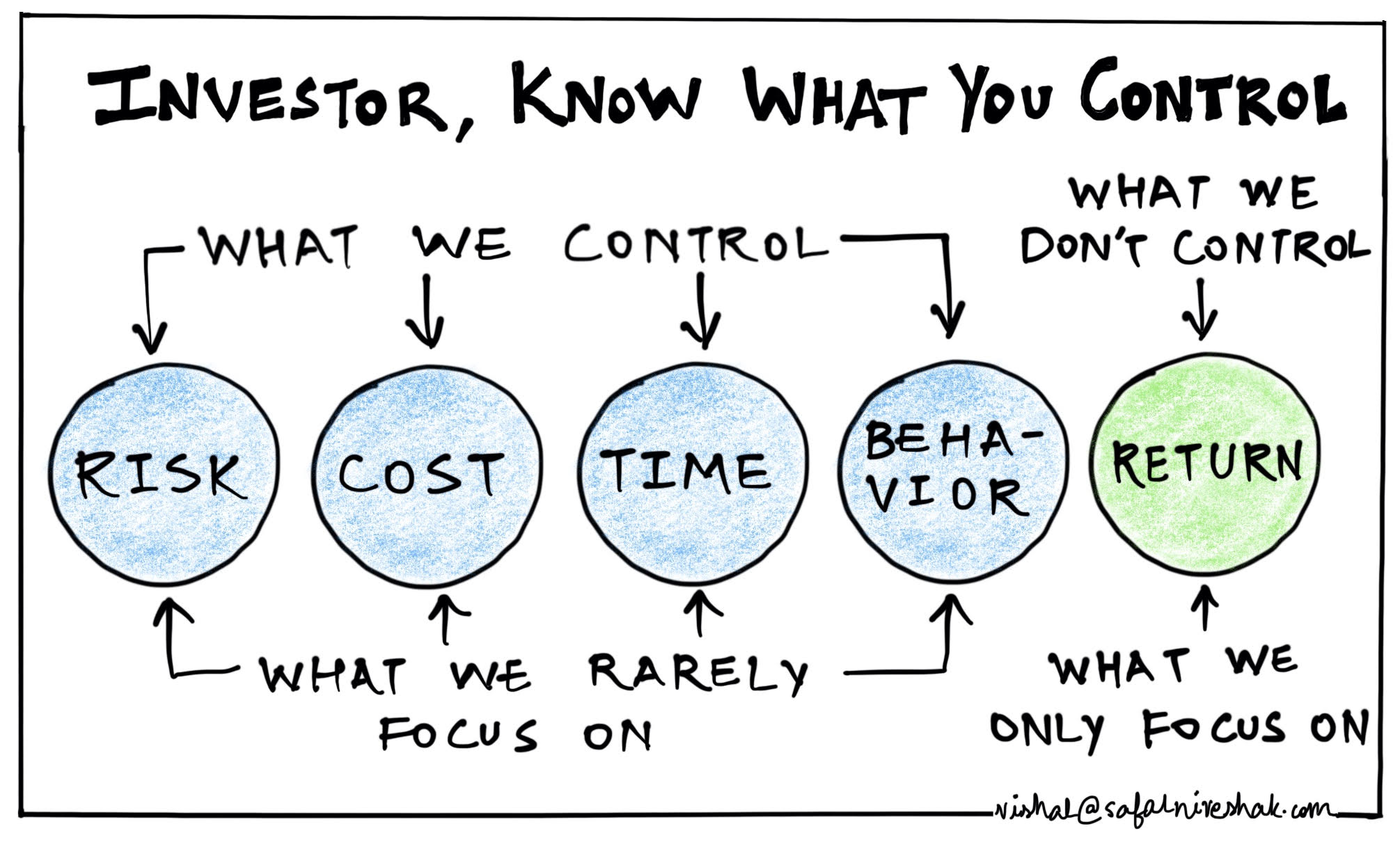

Focus on What You Can Control

You can’t tame the market, but you hold the reins on your knowledge and mindset. Revisit your trade history, analyze wins and flops. Tap into tools like Nansen or DeBank for deeper market insights, or track whale wallets to decode their strategies. The more you learn and stay sharp, the less emotions sway you. That’s the path to lasting success.

Don’t Rush to Recover Capital

Post-loss, the urge to “win it all back” burns strong. But that itch often leads to reckless moves—high leverage or nonstop trading—that tank accounts. Hold steady instead. Wait for the market to calm and signals to clarify before jumping in. Smart investors master self-control and strike at the right moment, not in the heat of chaos.

Pain Fuels Growth, Awareness Builds Strength

This brutal downturn offers a silver lining: it exposes your weak spots. You learn caution and grit from it. Sure, your pace might slow, but each step grows surer. Adversity doesn’t just mature you—it reveals your true worth.

Sticking Around Puts You Ahead of the Pack

If you’re still reading this, you haven’t quit despite the bruises. Compared to the 90% who’ve bailed, you’ve got something they lack: persistence and guts. Losses don’t define you—how you rise above them does. These trials forge you into a tougher, savvier investor.

Slow Down, Care for Yourself—The Future Stays Bright

Markets ebb and flow, and you’ll grow through every wave. A steady mind and sharper awareness unlock long-term wins. As you refine yourself, new chances will emerge quietly. When they do, you’ll stand ready to climb to the top and greet a dazzling future.

Conclusion: Turn Setbacks Into Stepping Stones

A market crash doesn’t mean defeat—it’s a call to adapt and thrive. By slowing down, nurturing yourself, and sharpening your skills, you transform chaos into opportunity. The storm may rage now, but your resilience and growth will light the way forward. Stay in the game, keep learning, and watch how this chapter becomes the foundation of your future success.