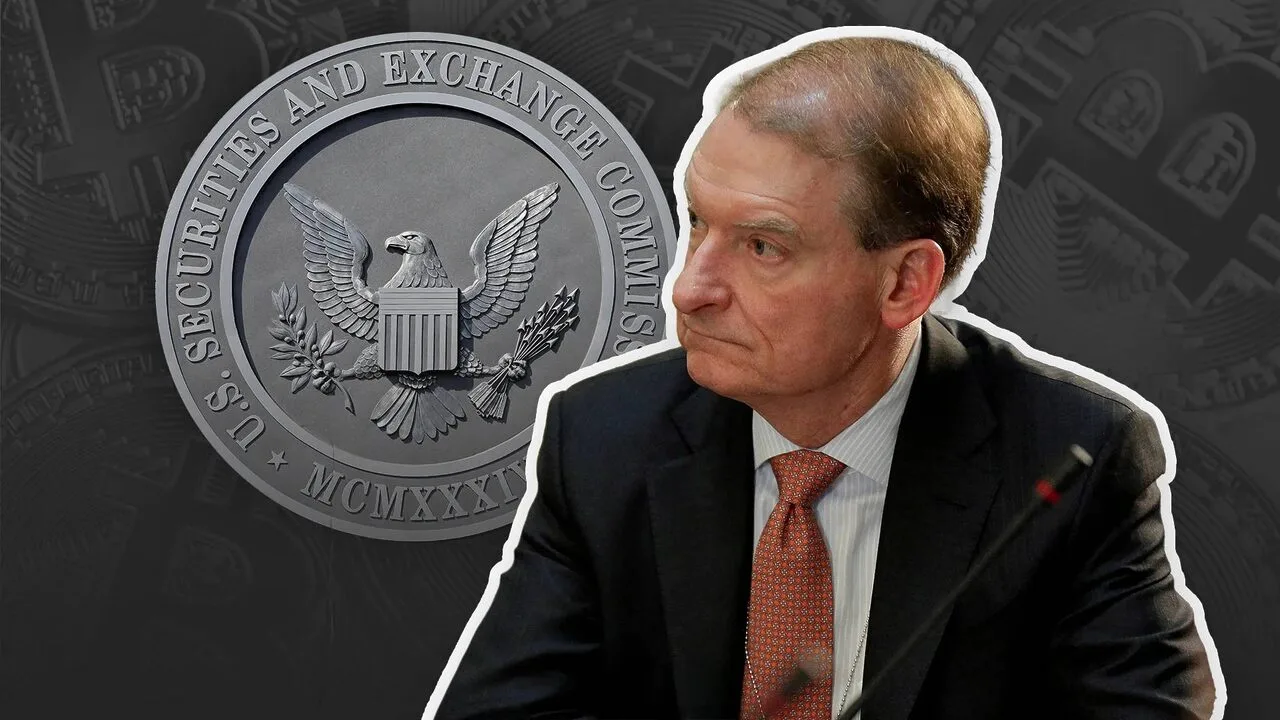

On April 9, 2025, the U.S. Senate officially confirmed Paul Atkins as the new Chairman of the Securities and Exchange Commission (SEC) with a 52-44 vote, ushering in a pivotal shift for the cryptocurrency market. Announced via Coin68, this decision marks the end of Gary Gensler’s tenure, which concluded in January 2025, and signals a potential thaw in the SEC’s historically stringent stance on digital assets. Atkins, a seasoned financial expert and former SEC Commissioner from 2002 to 2008, brings a pro-crypto perspective that could reshape regulatory approaches to Bitcoin, Ethereum, and beyond. This SEO-optimized article delves into Atkins’ confirmation, his background, and what it means for the crypto industry in 2025.

A Pro-Crypto Leader Takes the Helm

Paul Atkins is no stranger to the SEC or the financial world. During his prior tenure as an SEC Commissioner under President George W. Bush, he navigated the agency through the 2008 financial crisis, earning a reputation for balanced regulation. After leaving the SEC, Atkins founded Patomak Global Partners in 2009, a consultancy advising banks, crypto exchanges, and DeFi protocols on compliance and risk management. His involvement with the Token Alliance from 2017 to 2024 further solidified his support for blockchain technology and cryptocurrency innovation, advocating for clearer, less restrictive policies.

The confirmation process wasn’t without hurdles. Delayed by weeks due to mandatory financial disclosures, Atkins faced growing scrutiny. The delay was tied to his marriage into the wealthy TAMKO family, whose combined net worth exceeds $327 million. This includes $6 million in crypto investments. Critics, especially Senator Elizabeth Warren, voiced concerns over his past consulting work for the now-defunct FTX in 2022. However, no evidence links him to the platform’s collapse. Despite opposition from some Democrats, Republican backing secured his appointment, aligning with President Donald Trump’s pro-crypto agenda.

A Shift from Gensler’s Crackdown

Under Gary Gensler, the SEC earned a fearsome reputation in the crypto community, dubbed “Operation Choke Point 2.0” for its aggressive enforcement. High-profile lawsuits against Coinbase, Binance, and Ripple, alongside controversial rules like SAB 121, stifled crypto growth. Gensler’s exit in January 2025, followed by interim moves to drop lawsuits and soften regulations, hinted at change. Atkins’ confirmation accelerates this pivot. Posts on X and industry analysts suggest his leadership could prioritize crypto-friendly regulations, fostering innovation while maintaining oversight.

What Atkins’ Leadership Means for Crypto

Atkins’ tenure, set to run until June 2026, promises a departure from the SEC’s past hostility. His experience with digital assets—including personal investments—positions him to craft policies that support Bitcoin ETFs, tokenization, and DeFi growth. The SEC has already begun retracting restrictive measures, establishing a crypto task force to draft new guidelines. Experts predict Atkins may expedite approvals for Ethereum ETFs and explore frameworks for altcoins like Solana and XRP, long stalled under Gensler.

This shift aligns with global crypto adoption trends. With Bitcoin hitting $109,000 in January 2025, the U.S. risks lagging without regulatory clarity. Atkins’ balanced approach—rooted in his Patomak work with crypto firms—could make the U.S. a hub for blockchain innovation, attracting investment and talent.

Conclusion

Paul Atkins’ confirmation as SEC Chairman on April 9, 2025, heralds a transformative moment for the cryptocurrency market. Replacing Gensler’s hardline stance with a pro-crypto vision, Atkins is poised to redefine the SEC’s role in the digital asset space. For crypto investors and enthusiasts, this is a call to action—stay informed as regulations evolve and seize opportunities in this new era. The future of Bitcoin, Ethereum, and altcoins in the U.S. looks brighter than ever under Atkins’ watch.