In a bold move blending traditional finance with the digital asset frontier, Trump Media & Technology Group has announced a $250 million initiative to launch cryptocurrency exchange-traded funds (ETFs) and separately managed accounts (SMAs) in partnership with Crypto.com and Charles Schwab. Unveiled in late March 2025, this ambitious plan aims to capitalize on the growing crypto boom, integrating Bitcoin, Cronos, and other digital assets into investment products under the newly launched Truth.Fi brand. As cryptocurrency gains traction globally, this Trump Media crypto ETF venture could redefine how investors engage with digital finance while amplifying the company’s presence beyond its Truth Social platform.

A Strategic Leap into Crypto Finance

Trump Media, the parent company of the conservative-leaning social media platform Truth Social, is diversifying its portfolio with this foray into financial services. The Truth.Fi brand, introduced in January 2025, marks the company’s pivot toward fintech innovation. This $250 million investment, backed by Charles Schwab’s asset management expertise, marks a shift from media to a broader financial strategy. It positions cryptocurrency as a key element of modern investing. Partnering with Crypto.com adds strong technological support. The exchange provides custody, backend services, and access to assets like Bitcoin (BTC) and its native token, Cronos (CRO).

The ETFs will include both traditional stocks and crypto assets. They will feature patriotic themes like “Truth.Fi Made in America ETF” and “Truth.Fi Bitcoin Plus ETF.” These products target investors seeking financial returns and national pride. They also align with Trump Media’s vision. By leveraging Charles Schwab’s expertise, the initiative ensures strong financial backing. Meanwhile, Crypto.com’s blockchain capabilities enhance efficiency. This collaboration aims to connect Wall Street with the decentralized crypto space seamlessly.

How the Partnership Works

The collaboration splits responsibilities strategically. Crypto.com will handle the crypto side, offering custody services and integrating digital assets into the ETFs. This includes Bitcoin, the largest cryptocurrency by market cap, and Cronos, which powers Crypto.com’s ecosystem. Charles Schwab, a titan in traditional finance with decades of experience, will manage the $250 million in assets, ensuring regulatory compliance and broad distribution. Foris, a Crypto.com affiliate, will aid in rolling out these products to investors worldwide.

This Crypto.com partnership taps into the exchange’s growing influence, with its user base exceeding 80 million globally by early 2025. Meanwhile, Charles Schwab crypto involvement underscores a trend of legacy firms embracing digital assets, building on its prior explorations into crypto-related offerings. Together, they aim to create ETFs that appeal to both seasoned crypto enthusiasts and traditional investors dipping their toes into the market.

Why Now? The Crypto Boom and Trump’s Vision

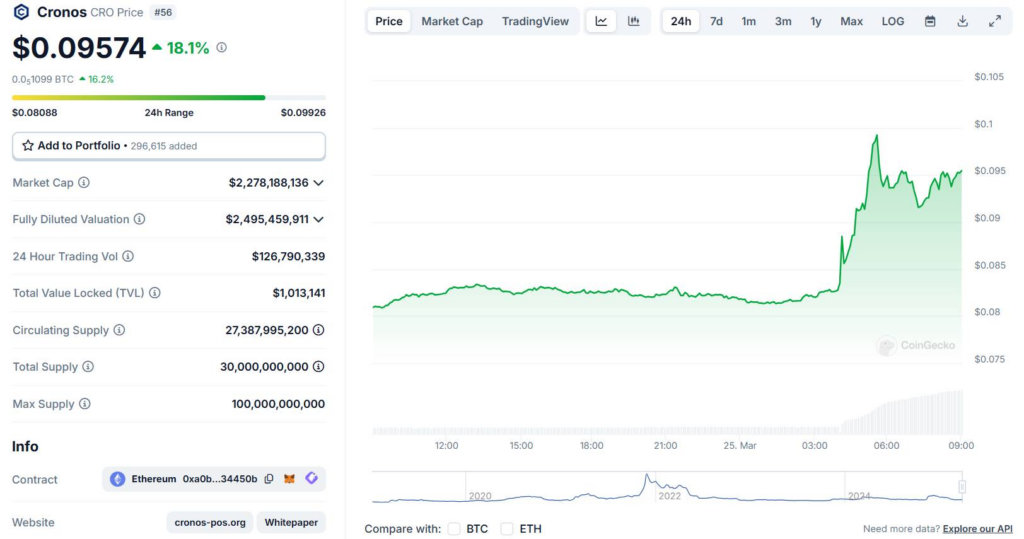

CRO token price movement in the last 24 hours, screenshot from CoinGecko at 09:05 AM on March 25, 2025.

The timing of this announcement aligns with a surging cryptocurrency market, which has seen Bitcoin hover near $80,000 and the total crypto market cap exceed $2.5 trillion in March 2025. Trump Media’s move comes amid a pro-crypto wave in the U.S., bolstered by recent policy shifts favoring digital assets. The company’s leadership, closely tied to former President Donald Trump, has positioned this as part of a broader mission to make America a leader in blockchain innovation—a nod to Trump’s earlier pledge to turn the U.S. into the “crypto capital of the world.”

At the end of 2024, Trump Media held over $700 million in cash reserves. It views this $250 million allocation as a way to diversify assets. The move also aims to capitalize on growing investor interest in crypto ETFs. These funds track cryptocurrency prices without requiring direct ownership. Since BlackRock’s iShares Bitcoin ETF set fundraising records in 2024, demand for such products has surged. Trump Media’s entry into this space could further fuel the trend, offering a unique blend of patriotism and profit potential.

Market Reaction and Future Prospects

The announcement boosted Trump Media’s stock (DJT) by 10.5% in after-hours trading on March 24, 2025. This surge comes despite a 38% decline over the past year. Investors see the Truth.Fi ETFs as a new revenue source for a company previously dependent on social media. Analysts believe this could attract crypto-curious retail investors. Meanwhile, Crypto.com’s technology and Schwab’s credibility may help ensure scalability.

Looking ahead, the success of this venture hinges on execution. Regulatory hurdles remain a challenge, as U.S. authorities continue to scrutinize crypto ETFs. However, with Charles Schwab’s compliance expertise and Crypto.com’s blockchain prowess, Trump Media is well-positioned to navigate these waters. If successful, Truth.Fi could expand beyond ETFs into other crypto products, further solidifying its fintech ambitions.

Conclusion

Trump Media’s $250 million crypto ETF plan with Crypto.com and Charles Schwab is a bold move into the future of finance. By combining traditional stocks with digital assets under the Truth.Fi brand, the company is securing its place in the evolving crypto space. As the ETF takes shape, it aims to push stablecoin payments and blockchain innovation into the spotlight, attracting global investors. Whether this turns Trump Media into a fintech leader or remains a high-stakes experiment, one thing is clear: crypto is now mainstream, and Trump Media is making its move.